THE PERSONAL FINANCE ACCELERATOR™ COACHING PROGRAM

A money coaching program, designed to help individuals and couples actually save money towards their most important goals–and help you do it fast.

Do you ever feel like there has to be an easier way to reach your financial goals?

—

Like buying a house, paying off debt, investing, and having enough savings will take forever?

It doesn’t have to be that way.

In the Personal Finance Accelerator™ (PFA™) program, we will work with you on “how” to get where you want to be — faster.

PROBLEMS WE SOLVE

- Helping households know what financial goal to focus on first

- Helping households stop living paycheck to paycheck

- Living on little to no income

- Preparing household finances for retirement

- Getting on the same page as a spouse

- Going from dual income to single income

- Manage money after a job loss

- Successfully managing major changes in income (increases or decreases)

- Building an emergency fund quickly

- Helping a working parent become a stay at home parent

- Buying a house

- Paying off debt

- Financially rebuilding after a divorce

- Removing impulse spending

- Managing finances as an engaged couple

- Newlywed finances

- Addressing how you were raised with money

- Finding the balance between spending and saving

- Handling money with teenagers

- Managing money with young kids

- Managing money as a single professional

- Managing money as a student

- Managing money as married students

- Helping couples to stop arguing about money

- Removing stress/guilt about money

Dan and Kay Ockey, Founders of Centsei

THESE ARE ALL SOLVED THROUGH IMPLEMENTING

THE FINANCIAL GROWTH SYSTEM

——

Here’s how we help you implement it…

HOW THE PFA COACHING PROGRAM WORKS

ONE-ON-ONE COACHING

This is where the magic happens. You will meet with a Centsei coach weekly one-on-one for 6-8 weeks to do all the heavy lifting: custom budget set up, creating your personal financial roadmap, setting up your automatic tracker, work through mindset shifts– your entire financial system will be up and running by the end of these calls.

Then, your coach will stick with you, for one-on-one accountability calls for 24 months (!!!) to make sure real behavior change has happened.

No financial crash diets here.

1000+ Online Member Community

You don’t have to do finances alone. Every member in this private community has been through the Personal Finance Accelerator Program. The culture in this community is unmatched- supportive, real, and positive.

We ride the highs and lows together, celebrate our successes, ask questions, hold each other accountable and crowd source ideas.

This is your team.

ARE YOU READY TO START MAKING REAL FINANCIAL PROGRESS?

WHAT’S INCLUDED

Weekly one-on-one Coaching Calls for 6-8 Weeks

One-on-one Accountability Coaching Calls for 24 Months

Money Mindset Toolbox

The Four Step Framework to Cutting Expenses

10+ Action Packed Modules

Exclusive Goal Based Budgeting System

The 9 Step Process to Increase Your Long Term Income

40+ Page Workbook

1000+ Member Community

2 Years Free Monarch Access

Discussion Questions/Journal Prompts

100 Income Ideas From Real Clients

COACHING | COMMUNITY | COURSES | TOOLS

ALL INCLUDED IN THE PERSONAL FINANCE ACCELERATOR PROGRAM

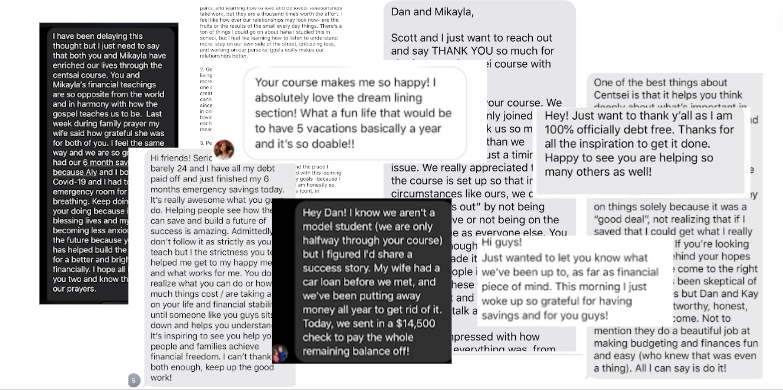

WHAT OTHERS ARE SAYING

15.5k of debt paid off in 8 months

“We finished paying off one of our cars today. Starting on our student loans now. Hoping to be done with that by April and then onto our 6 month savings. This program has broken and rebuilt our marriage and the way we look at money. Can’t wait to give you more updates with time!”

18k of debt paid off, 10k emergency fund, and bought a house in 24 months

“Our biggest accomplishment this year is purchasing a home!! We could not have done it without the Centsei system helping us create a system and save and track our expenses!!”

45k saved in one year + investing

“When I initially joined, I had horrible anxiety around money. I felt guilty spending money, going on vacation and hated looking and paying off my credit cards. A year later, I feel confident and free to spend while still hitting my goals! I have loved being able to plan trips and weddings without worrying. Life has been so much more enjoyable the last year!”

WE GUARANTEE RESULTS – OR YOU DON’T PAY

GUARANTEE #1: If you don’t save or make $500 in the first 3 months you get a full refund.

GUARANTEE #2: If you don’t save or make $5,000 in the first year you get a full refund.

INVESTMENT: It’s just $200/mo to get started.

ARE YOU READY TO START MAKING REAL FINANCIAL PROGRESS?

About Us

After accomplishing our first financial goal together (paying off our $20,000 of debt in 6 months as college students), we were hooked on making real financial progress.

We soon realized that the old system of percentages and “just earn more money” were not necessarily the solutions to modern money problems.

That’s why we created the Financial Growth System that we now teach inside the Personal Finance Accelerator™.

THE RESULTS SPEAK FOR THEMSELVES

95k of Debt paid off in 18 mo

“We miss meeting with our coach! Combining our two families later in life has been complex enough – not to mention adding figuring out money. We wouldn’t have done what we’ve been able to without Centsei.”

Debt Free Grad School with 14k Emergency Fund in 7 months

“Just had our financial check-in, and I am feeling so grateful and peaceful. I’m feeling especially grateful today for the SYSTEMS. I have felt so much peace knowing there is a plan that WORKS when I felt so much despair before. We’ve been really consistent for the last 7 months, and it’s, really, really exciting to see our progress.“

115k of debt paid off in 12 mo

“We did things we never would have done on our own if we hadn’t been encouraged. Having a Centsei Coach who pushed us but encouraged at the same time made all the difference. We wouldn’t have done this without a coach.”

ARE YOU READY TO START MAKING REAL FINANCIAL PROGRESS?

WHAT YOU WILL GET ON YOUR FREE CALL WITH A CENTSEI COACH?

1.We’ll go over your current financial situation and how you currently manage money.

2. We’ll look at where you want to be financially and share our thoughts on your situation.

3. We’ll see if it makes sense for you to go through our Personal Finance Accelerator Program to implement The Financial Growth System.

FAQ

How long will I have coaching?

This is a 24 month program. After 24 months of coaching, you will continue to have lifetime access to the modules and community.

We are continually making updates and we want you to have access to the latest version of the modules.

How much does it cost?

INVESTMENT: It’s just $200/mo to get started.

GUARANTEE #1: If you don’t save or make $500 in the first 3 months you get a full refund.

GUARANTEE #2: If you don’t save or make $5,000 in the first year you get a full refund.

Because our coaches work with you 1-on-1, you will clearly be able to see if this is working for you or not.

If it’s not working, we don’t want your money!

We are already debt-free. Is this program for me?

Yes! That is one of the biggest misconceptions we see. Whether you are swimming in debt or already paid it all off, (way to go!) there is still SO much you can learn from this program!

I still have questions. Who do I contact?

Book a call with one of our Centsei Coaches. or you can contact us at hello@centseifinancial.com