Welcome to the Case Study Series! We’re all a little nosey when it comes to money—curious about how others are really doing behind the Instagram filters and financial advice soundbites. At Centsei, we believe in pulling back the curtain and showing the real numbers behind real people’s finances.

These aren’t theoretical budgets or polished success stories. These are honest, unfiltered financial journeys—net income, savings, debt, goals, and all. In this blog series, we’re sharing stories from everyday clients who partnered with Centsei to take control of their money.

You’ll see where they started, what their money looked like month-to-month, and the actual progress they made over time. Because let’s be honest—seeing someone else crush their money goals is way more inspiring than another ‘just cancel Netflix’ tip.

____

Meet a couple in their mid-20s.

No kids. Solid income. Some savings, some debt, and big dreams of owning a home and getting ahead financially. They joined Centsei’s Personal Finance Accelerator in July 2023, ready to stop guessing with their money and start making real progress.

Here’s what things looked like when they started:

$10,426 net income

About $9,000 saved for a house

$7,000 emergency fund

Nearly $30,000 in debt (car loan + student loans)

Goals: Buy a house, get in control of their money, get ahead

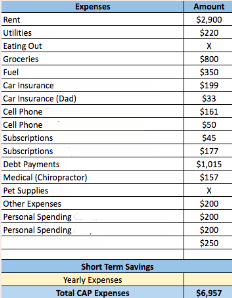

What a typical month looks for them after joining Centsei:

**Some information has been removed for privacy**

In less than 2 years they:

1. Have paid off their debt

2. Saved a full 6 month emergency fund

3. Are investing 15%

4. Have/about to close on a house.

EST. TOTAL TOWARDS GOALS: $83,256+

PS: Want to see how your story goes? Book a Call with a Centsei Coach.

Let’s Talk about Finances!

Let’s talk about your current financial situation, and where you want to be.