One of the craziest phenomenons I’ve experienced through coaching married couples financially with my wife is the crazy desire to buy a house AS SOON AS POSSIBLE.

It’s like people would rather die than pay rent.

“I hate the feeling that I’m just throwing money away.” — Most people currently renting.

This has caused Mikayla (my wife) and I to think about buying a house in depth — is renting really just throwing money away?

Turns out — not always, and not most of the time. Especially while we’re young.

Let’s dig into the tools.

Tool #1— “The 25/20% Rule”

Probably one of the most helpful rules I’ve come across in reading as many personal finance books I can is the 25/20% rule when it comes to total house costs.

When people think about buying a house, they don’t think about how much a house really costs. It’s not just a mortgage:

- Property tax

- House repair expenses (Ever had a water heater go out?)

- Lawn care

- Furnishing the whole house. (Are you going to have empty rooms?)

- Utility expense increases

- Increased pressure to keep up with the Jones….(your neighbor drives nicer cars)

- Home Insurance

These are just some of the main expenses that increase in addition to buying a home. None of this is included when you are just paying rent! Your landlord is taking care of it. This can add up to several hundred dollars a month!

A good rule of thumb is to try to keep all of these expenses under 25/20% of your monthly after-tax income.

The 20% part of this rule is that you should not buy a house unless you can put at least 20% down. I see too many couples buying a house with FHA loans putting 3%-10% down. This will increase your expenses several hundred dollars because you must pay mortgage insurance.

People — WAIT TO BUY A HOUSE UNTIL YOU CAN PUT 20% DOWN AND YOUR MONTHLY HOME EXPENSES DO NOT EXCEED 25% OF YOUR AFTER TAX INCOME.

That is all.

This will always keep you in good shape. It doesn’t matter how well the housing market is doing or how fast it is appreciating. Keeping the 25/20% rule will make sure you are never house poor.

Tool #2 — Get a 15 Year Mortgage Instead of a 30

Ah, the age old classic. 15 year Mortgages vs 30 year Mortgages — what to do, what to do.

Always go for the 15 year Mortgage.

Here is why:

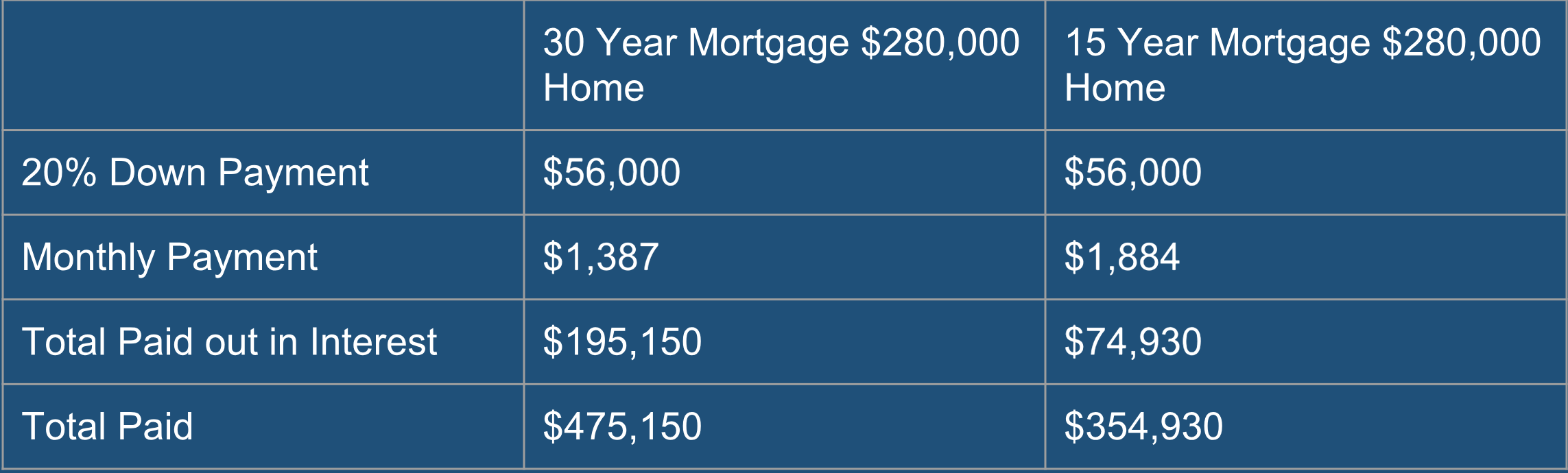

The total amount paid in interest is a little more than $120,000 DOLLARS.

Most of you are making that in 2–3 YEARS.

It’s decisions like this that put you ahead.

The other thing about 15 year Mortgages, is that you tend to pay them off, well, in 15 years.

One may have to save longer to achieve the 25% rule as 15-year mortgages come with larger monthly payments, but if you look at the big picture, it’s worth it.

Tool #3 — The Rent to Buy Ratio

One of the neatest tools we’ve found in our personal finance journey is the Rent to Buy Ratio Calculator.

It calculates how much you’ll pay in rent vs a mortgage, and it is VERY thorough.

This ratio shows us that even though sometimes we have the money to buy a house, renting is still actually cheaper. Enter your current situation and where you think you will be in 5 years. It’s interesting. Taking time here will change your perspective.

Bonus Tool #4 — Your Needs, Practicality, and Emotion

While all of the previous tools are useful, there is more to it than just plain numbers. While I do feel that Tools #1 and #2 should always be used, sometimes it will be more expensive to buy than to rent and that’s okay.

Your family’s needs, and just plain ole’ practicality sometimes speak otherwise. Every once and a while it is good to go with your gut, but if you follow Tools #1 and #2, it will be hard to go astray.